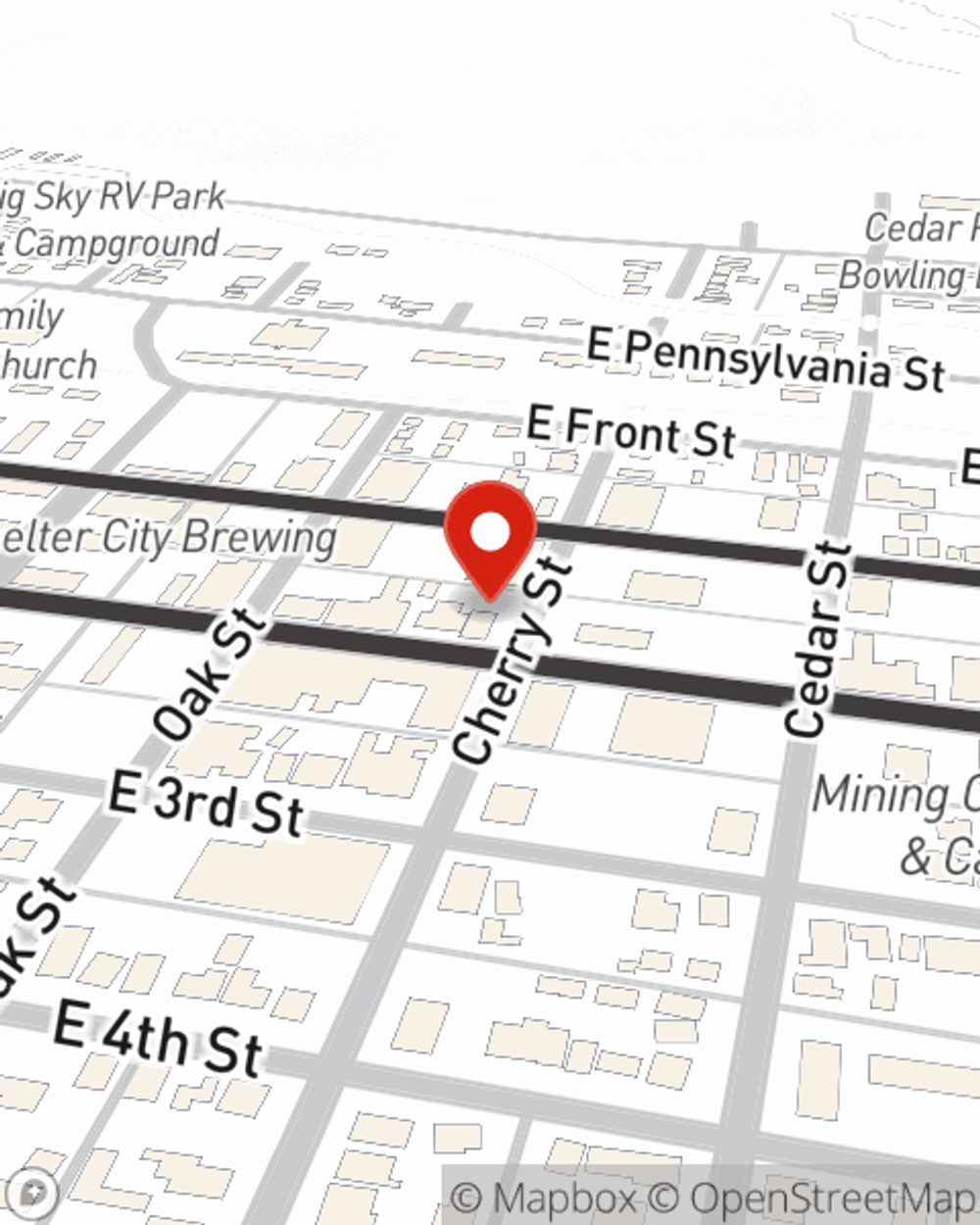

Renters Insurance in and around Anaconda

Renters of Anaconda, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Calling All Anaconda Renters!

No matter what you're considering as you rent a home - price, size, furnishings, apartment or condo - getting the right insurance can be crucial in the event of the unexpected.

Renters of Anaconda, State Farm can cover you

Renters insurance can help protect your belongings

There's No Place Like Home

When the unexpected accident happens to your rented property or home, often it affects your personal belongings, such as a bicycle, a desk or a video game system. That's where your renters insurance comes in. State Farm agent Mike King wants to help you evaluate your risks so that you can keep your things safe.

It's always a good idea to make sure you're prepared. Contact State Farm agent Mike King for help learning more about coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Mike at (406) 563-2991 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.